Get Utility Bill Form

Key takeaways

Filling out and using the Utility Bill form can seem daunting, but it doesn't have to be. Here are some key takeaways to help you navigate the process smoothly.

- Gather Necessary Information: Before starting, collect all relevant details such as your account number, service address, and billing period.

- Read Instructions Carefully: Each form may have specific guidelines. Take a moment to read them to avoid mistakes.

- Use Clear and Legible Writing: Whether you’re filling out the form by hand or digitally, clarity is crucial. Ensure all entries are easy to read.

- Double-Check Your Entries: After completing the form, review it for accuracy. Mistakes can delay processing.

- Submit on Time: Be aware of submission deadlines. Late submissions may result in penalties or service interruptions.

- Keep a Copy: Always make a copy of your completed form for your records. This can be helpful for future reference.

- Know Your Rights: Familiarize yourself with your rights regarding utility services. Understanding these can empower you in case of disputes.

- Follow Up: After submission, don’t hesitate to follow up with your utility provider. Confirm they received your form and inquire about the next steps.

By keeping these points in mind, you can ensure a smoother experience with the Utility Bill form.

Similar forms

The Utility Bill form serves as an essential document for various purposes, often resembling several other types of documents. Here’s a look at eight documents that share similarities with the Utility Bill form:

- Bank Statement: Like a utility bill, a bank statement provides a record of transactions over a specific period. Both documents serve as proof of financial responsibility and can be used to verify identity or residency.

- Lease Agreement: A lease agreement outlines the terms of renting a property. Similar to a utility bill, it can confirm residency and may be requested by landlords or service providers to verify a tenant’s address.

- Credit Card Statement: This document summarizes the activity on a credit card account. Both credit card statements and utility bills reflect regular payments and can be used to demonstrate financial habits or stability.

- Tax Return: A tax return provides a comprehensive view of an individual’s income and financial status. Like a utility bill, it can be used to verify identity and is often required for loans or other financial applications.

- Insurance Policy: An insurance policy details the coverage and terms of an insurance agreement. Both documents can confirm an individual’s address and may be necessary when applying for certain services or benefits.

- Pay Stub: A pay stub provides a breakdown of earnings and deductions from an employee’s paycheck. Similar to a utility bill, it serves as proof of income and can be used in various applications.

- Government-Issued ID: A government-issued ID, such as a driver's license, confirms identity and residency. While it serves a different primary function, both documents can be used to validate personal information.

- Georgia WC-100 Form: This form is crucial for initiating mediation in workers' compensation claims in Georgia. For more details, visit the Georgia PDF which offers comprehensive information on its usage and importance.

- Utility Account Statement: This is a more detailed version of a utility bill, often including account activity over time. It serves the same purpose as a utility bill but may provide additional insights into usage patterns.

Understanding these documents and their similarities can help individuals navigate various processes, from applying for loans to verifying their identity. Each serves a unique purpose while sharing common elements that validate personal information and financial responsibility.

Misconceptions

When it comes to utility bills, many people have misunderstandings that can lead to confusion or frustration. Here are eight common misconceptions about the Utility Bill form:

- Utility bills are always the same amount each month. Many people believe their utility bills will remain constant. In reality, usage varies based on seasons, activities, and other factors, which can lead to fluctuations in the bill.

- Utility companies can shut off service without notice. Some think that utility companies can disconnect service at any time. However, most companies are required to provide notice before shutting off service, typically offering customers a chance to resolve any outstanding payments.

- All utility charges are mandatory. While basic service charges are typically unavoidable, there may be optional services or fees that customers can choose to decline. Understanding what each charge is for can help in managing costs.

- Late payments will not affect my credit score. Many assume that utility bills do not impact credit. However, if a bill goes unpaid for an extended period, it can be sent to collections, which can negatively affect credit scores.

- My utility bill reflects only my usage. Some people think their bill only shows what they used. However, it may also include taxes, fees, and other charges that can significantly affect the total amount due.

- Utility bills are always accurate. While utility companies strive for accuracy, mistakes can happen. It’s important to review bills regularly and report any discrepancies to ensure proper billing.

- I cannot dispute my utility bill. Many believe that once they receive a bill, they must pay it without question. In fact, customers have the right to dispute charges they believe are incorrect.

- Paying my utility bill late is not a big deal. Some think that a late payment is just a minor inconvenience. However, late payments can lead to additional fees and even service disconnection, which can be a hassle to resolve.

Understanding these misconceptions can help individuals manage their utility bills more effectively and avoid unnecessary stress.

More PDF Templates

Where to Fax Form 433-d - Filling out the 433-F is beneficial for anyone unable to pay taxes in full.

Salary Advance Agreement - Secure the necessary funds by submitting this advance request.

To successfully establish a corporation in New York, individuals must fill out the Articles of Incorporation form, which requires specific details about the corporation, including its name, purpose, and structure. For those looking for assistance or templates, resources such as NY PDF Forms can be particularly helpful in streamlining the process.

Odometer Disclosure Statement Indiana - The California DMV outlines additional resources for vehicle buyers and sellers.

Form Specs

| Fact Name | Description |

|---|---|

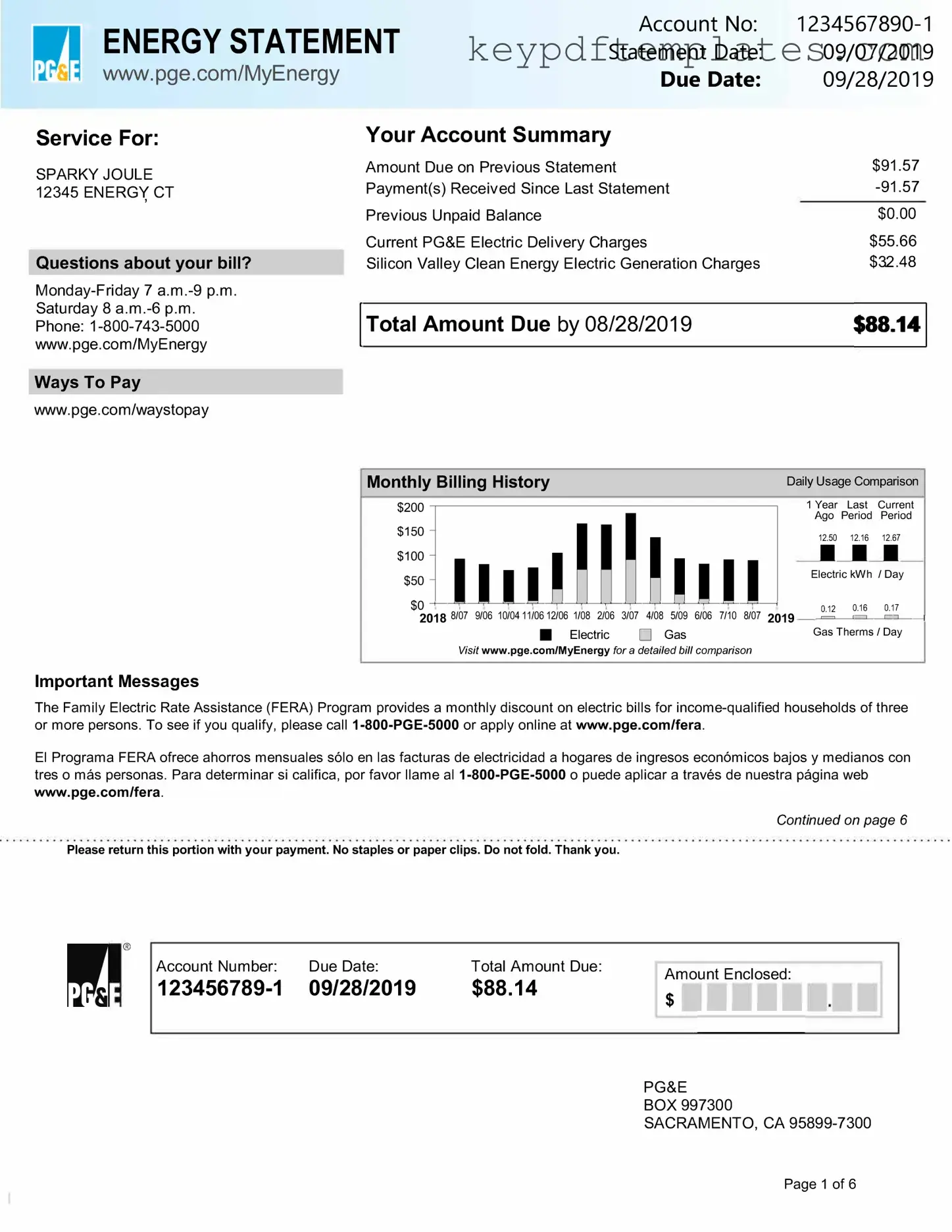

| Purpose | The Utility Bill form is used to document and verify utility expenses for various purposes, including financial assistance applications and loan approvals. |

| Common Utilities | This form typically includes charges for electricity, water, gas, and sometimes internet or cable services. |

| Required Information | Users must provide their name, address, account number, and the billing period covered by the utility bill. |

| State-Specific Forms | Some states have specific forms that must be used. For example, California requires the Utility Bill form to comply with the California Public Utilities Code. |

| Submission Methods | The form can often be submitted online, via mail, or in person, depending on the agency or organization requesting it. |

| Verification Process | After submission, the information provided is usually verified against utility company records to ensure accuracy. |

| Importance of Accuracy | Filling out the form accurately is crucial. Errors can lead to delays in processing applications or even denial of assistance. |

Documents used along the form

When managing household utilities, various forms and documents may accompany the Utility Bill form. Each serves a specific purpose, ensuring that billing, service, and account management proceed smoothly. Below is a list of commonly used documents.

- Service Agreement: This document outlines the terms and conditions of utility service between the provider and the customer. It details the rights and responsibilities of both parties.

- Change of Address Form: When moving, this form notifies the utility company of a new address, ensuring that bills are sent to the correct location.

- Payment Plan Agreement: This agreement allows customers to set up a structured payment plan for their utility bills, making it easier to manage costs over time.

- Vehicle Management Authorization: For those needing to delegate vehicle-related tasks, the Motor Vehicle Power of Attorney form is essential for efficient transactions and ensures that your vehicle matters are handled properly.

- Dispute Resolution Form: If there is a disagreement about a bill or service, this form helps document the issue and initiate a resolution process with the utility provider.

- Authorization Form: This document grants permission for a third party to manage the utility account on behalf of the account holder, often used in cases of financial assistance or caregiving.

- Meter Reading Form: Utility companies may use this form to record manual meter readings, ensuring accurate billing based on actual usage rather than estimates.

- Service Cancellation Form: When a customer wishes to terminate their utility service, this form formally requests the cancellation and provides necessary details for processing.

- Billing Statement: This document provides a detailed account of usage, charges, and payment history, allowing customers to track their utility expenses over time.

- Energy Efficiency Program Application: Some utility companies offer programs to improve energy efficiency. This application form allows customers to apply for rebates or assistance in making their homes more efficient.

Understanding these documents can help individuals navigate their utility services more effectively. Each form plays a crucial role in ensuring transparency, accountability, and customer satisfaction in utility management.