Printable Vehicle Repayment Agreement Template

Key takeaways

When filling out and using the Vehicle Repayment Agreement form, several key points can help ensure a smooth process. Here are nine important takeaways:

- Understand the Purpose: The Vehicle Repayment Agreement is designed to outline the terms of repayment for a vehicle loan or lease. Familiarizing yourself with its purpose will help you fill it out accurately.

- Complete All Sections: Ensure that every section of the form is filled out completely. Missing information can lead to delays or complications in processing.

- Provide Accurate Information: Double-check all personal and vehicle details. Inaccuracies can result in issues with your repayment schedule.

- Review Payment Terms: Carefully read the repayment terms, including interest rates, payment amounts, and due dates. Understanding these terms is crucial for effective budgeting.

- Signature Requirement: Remember that the form must be signed by all parties involved. This signifies agreement to the terms laid out in the document.

- Keep a Copy: After submitting the form, retain a copy for your records. This will be useful for reference in case of disputes or questions in the future.

- Communicate Changes: If your financial situation changes, inform the lender as soon as possible. They may be able to adjust the repayment terms accordingly.

- Follow Up: After submission, follow up with the lender to confirm that the agreement has been processed. This ensures that there are no misunderstandings about your repayment plan.

- Seek Assistance if Needed: If you encounter difficulties while filling out the form, do not hesitate to seek help. Lenders often have representatives available to assist with questions.

Similar forms

The Vehicle Repayment Agreement form shares similarities with several other documents that are commonly used in financial transactions and agreements. Each of these documents serves a specific purpose but also includes elements that overlap with the Vehicle Repayment Agreement. Here’s a list of nine documents that are similar:

- Loan Agreement: This document outlines the terms under which a borrower receives funds from a lender. Like the Vehicle Repayment Agreement, it specifies repayment terms, interest rates, and consequences of default.

- Promissory Note: A promissory note is a written promise to pay a specified amount of money at a certain time. It is similar to the Vehicle Repayment Agreement in that it details the borrower's obligation to repay a loan.

- Lease Agreement: This document is used when renting a vehicle. It includes terms of use and payment, much like the Vehicle Repayment Agreement, but focuses on rental rather than ownership.

- Security Agreement: A security agreement grants the lender a security interest in the vehicle until the loan is paid off. This is similar to the Vehicle Repayment Agreement, which may also involve securing the loan with the vehicle itself.

- Installment Sale Agreement: This document outlines the terms of purchasing a vehicle through installments. It shares similarities with the Vehicle Repayment Agreement in terms of payment schedules and ownership transfer.

- Credit Agreement: A credit agreement lays out the terms under which credit is extended. Like the Vehicle Repayment Agreement, it includes details about repayment and interest rates.

- Bill of Sale: A bill of sale documents the transfer of ownership of a vehicle. While it primarily focuses on the sale, it can include payment terms that resemble those found in a Vehicle Repayment Agreement.

- Debt Settlement Agreement: This document outlines the terms of settling a debt for less than the full amount owed. It can be similar to the Vehicle Repayment Agreement in the context of renegotiating repayment terms.

- Texas Motor Vehicle Bill of Sale Form: To ensure a smooth transaction when buying or selling vehicles, refer to the comprehensive Motor Vehicle Bill of Sale documentation for precise guidelines and details.

- Forbearance Agreement: This agreement allows a borrower to temporarily postpone payments. It is similar to the Vehicle Repayment Agreement in that it addresses repayment terms but focuses on flexibility during financial hardship.

Misconceptions

Understanding the Vehicle Repayment Agreement form is crucial for anyone involved in financing a vehicle. Unfortunately, several misconceptions can lead to confusion. Here are five common myths about this important document:

-

It’s only for people with bad credit.

This is not true. While individuals with poor credit may use this form, anyone financing a vehicle can benefit from a Vehicle Repayment Agreement. It helps clarify payment terms, regardless of credit history.

-

Once signed, the terms can’t be changed.

Many believe that signing the agreement locks them into the terms forever. In reality, modifications can be made if both parties agree. Communication is key.

-

It guarantees loan approval.

Some think that completing this form automatically secures financing. However, approval depends on various factors, including creditworthiness and lender policies.

-

It only protects the lender.

This misconception overlooks the fact that the agreement also protects the borrower. It clearly outlines responsibilities and expectations, providing security for both parties.

-

All Vehicle Repayment Agreements are the same.

In reality, these agreements can vary significantly based on the lender and specific terms of the loan. Always read the document carefully to understand your obligations.

By debunking these myths, individuals can approach the Vehicle Repayment Agreement with a clearer understanding, ensuring a smoother financing experience.

Common Forms

Puppy Health Record - Keep track of the administration route for parasite control products.

For those looking to obtain a replacement for their vehicle's license plate or registration sticker, the txtemplate.com/texas-vtr-60-pdf-template/ offers a convenient resource to help ensure that the Texas VTR-60 form is completed accurately and submitted to the appropriate authorities, thus facilitating the smooth maintenance of your vehicle's registration status.

Free Printable Shower Sheets for Cna - Used to maintain quality care through detailed observation records.

PDF Details

| Fact Name | Description |

|---|---|

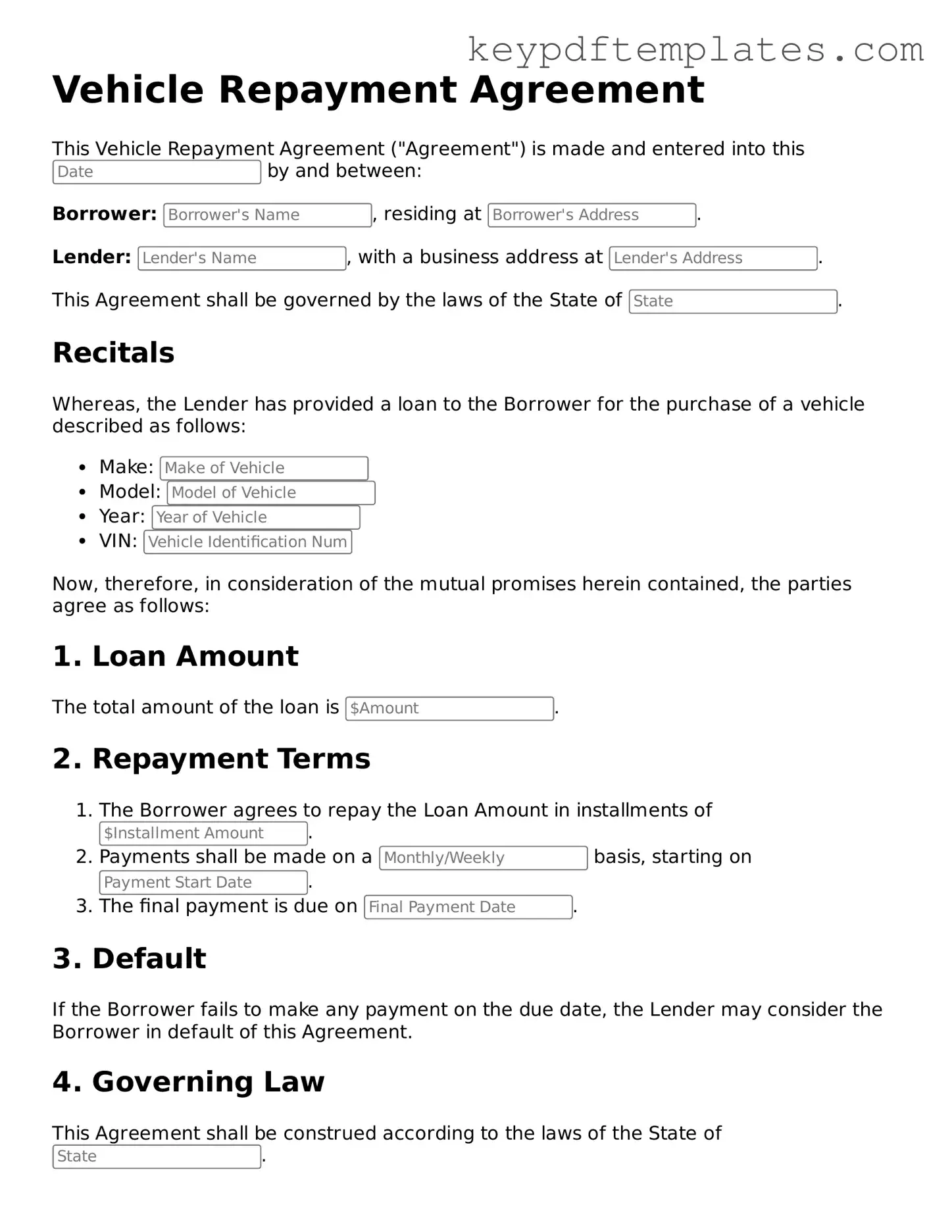

| Purpose | The Vehicle Repayment Agreement form is designed to outline the terms under which a borrower agrees to repay a loan for a vehicle. |

| Parties Involved | This agreement typically involves two parties: the lender (often a financial institution) and the borrower (the individual purchasing the vehicle). |

| Governing Law | The agreement is subject to state-specific laws, which can vary significantly. For example, in California, it is governed by the California Civil Code. |

| Payment Terms | It specifies the payment schedule, including the amount due, frequency of payments, and the total repayment period. |

| Default Provisions | The form outlines what constitutes a default, such as missed payments, and the consequences that follow, which may include repossession of the vehicle. |

| Signatures Required | Both parties must sign the agreement to indicate their acceptance of the terms. This step is crucial for the document's enforceability. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties to be valid. |

Documents used along the form

When dealing with a Vehicle Repayment Agreement, several other forms and documents often accompany it to ensure clarity and legality in the transaction. Each of these documents serves a specific purpose, helping both parties understand their rights and obligations.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount. It includes details such as the loan amount, interest rate, and repayment schedule.

- Loan Application: A form that the borrower fills out to request financing. It typically includes personal information, financial history, and details about the vehicle being financed.

- Title Transfer Document: This document facilitates the transfer of the vehicle's title from the seller to the buyer, ensuring that ownership is legally recognized.

- Bill of Sale: A legal document that records the sale of the vehicle. It includes information about the buyer, seller, vehicle details, and the sale price.

- Insurance Verification: A document that proves the borrower has obtained the necessary insurance coverage for the vehicle, which is often a requirement for financing.

- Georgia SOP Form: This document is essential for understanding the procedures for inmate visitation in Georgia's correctional facilities, ensuring that relationships between inmates and their families are maintained. For more details, refer to the Georgia PDF.

- Default Notice: This is a formal notification sent to the borrower if they fail to make payments as agreed. It outlines the consequences of defaulting on the loan.

Understanding these documents is crucial for anyone involved in a vehicle financing agreement. Each one plays a vital role in protecting the interests of both the lender and the borrower, ensuring a smooth transaction and clear communication throughout the process.