Get Independent Contractor Pay Stub Form

Key takeaways

When filling out and using the Independent Contractor Pay Stub form, there are several important points to keep in mind. Here are ten key takeaways to help you navigate the process effectively:

- Accurate Information: Always provide accurate personal and business information. This includes your name, address, and tax identification number.

- Clear Payment Details: Clearly state the payment amount and the date it was issued. This ensures transparency for both parties.

- Service Description: Include a brief description of the services rendered. This helps clarify what the payment is for.

- Tax Deductions: If applicable, indicate any tax deductions that were taken from the payment. This is essential for record-keeping.

- Keep Copies: Always keep a copy of the pay stub for your records. This can be useful for future reference or tax purposes.

- Use a Template: Consider using a template to ensure that you include all necessary information. This can save time and reduce errors.

- Review Before Sending: Review the completed pay stub for any mistakes. A simple error can lead to confusion or disputes.

- Understand Your Rights: Familiarize yourself with your rights as an independent contractor, including payment terms and dispute resolution.

- Communicate with Clients: If there are any discrepancies, communicate with your client promptly. Open communication can prevent misunderstandings.

- Consult Professionals: If you have questions about taxes or legal obligations, consult a tax professional or legal advisor for guidance.

By keeping these takeaways in mind, you can ensure that your use of the Independent Contractor Pay Stub form is effective and compliant with relevant regulations.

Similar forms

- W-2 Form: This document is issued by employers to report wages paid to employees and the taxes withheld. Like the Independent Contractor Pay Stub, it provides a summary of earnings and deductions, but it is specifically for employees rather than independent contractors.

- 1099-MISC Form: This form is used to report payments made to independent contractors. Similar to the Independent Contractor Pay Stub, it details the amount paid to the contractor, but it is used for tax reporting purposes rather than for payment tracking.

Texas VTR-60 Form: This form is essential for anyone needing to replace their vehicle's license plate(s) or registration sticker. To conveniently start the process and access the necessary documentation, visit txtemplate.com/texas-vtr-60-pdf-template.

- Invoice: An invoice is a document sent by a contractor to request payment for services rendered. Both the invoice and the Independent Contractor Pay Stub include details about the services provided and the amount owed, but the invoice is generated by the contractor while the pay stub is provided by the client.

- Payroll Summary: This document summarizes all payroll transactions for a specific period. It is similar to the Independent Contractor Pay Stub in that it provides a breakdown of payments and deductions, but it typically applies to employees rather than independent contractors.

- Payment Receipt: A payment receipt confirms that payment has been made for services. Like the Independent Contractor Pay Stub, it includes details about the payment amount and the services provided, but it serves as proof of payment rather than a summary of earnings.

Misconceptions

Understanding the Independent Contractor Pay Stub form can be challenging. Here are six common misconceptions that may lead to confusion.

-

Independent contractors do not need pay stubs.

While independent contractors are not employees, providing pay stubs can help them track their income and expenses. It can also serve as proof of earnings for tax purposes.

-

Pay stubs are only for employees.

This is incorrect. Independent contractors can also benefit from pay stubs. They offer a clear record of payments received, which is essential for financial management.

-

All pay stubs look the same.

In reality, pay stubs can vary significantly based on the contractor's business model and the payment structure. Different formats may include varying details, but they all serve the same purpose.

-

Independent contractors do not pay taxes.

This misconception can lead to serious financial consequences. Independent contractors are responsible for paying their own taxes, and accurate pay stubs can help keep track of taxable income.

-

Pay stubs are not legally required.

While there is no federal law mandating pay stubs for independent contractors, providing them is a best practice. They help maintain transparency and can prevent disputes over payments.

-

All deductions are automatically included on pay stubs.

This is not always the case. Independent contractors may need to account for their own deductions, such as self-employment taxes or business expenses, which may not appear on a pay stub.

By addressing these misconceptions, independent contractors can better understand the importance of pay stubs in managing their finances and ensuring compliance with tax obligations.

More PDF Templates

Profits or Loss From Business - If you operate multiple businesses, you’ll need separate Schedule Cs for each one.

In cases where a tenant fails to comply with rental agreements, the Florida Notice to Quit form becomes an indispensable tool for landlords, as it not only stipulates the need to vacate but also clarifies the legal basis for such action. For additional resources and guidance on this process, landlords and tenants can visit allfloridaforms.com.

Emotional Support Animal Letter From Therapist - The letter emphasizes the significance of companionship from an emotional support animal for individuals with mental health needs.

Form Specs

| Fact Name | Description |

|---|---|

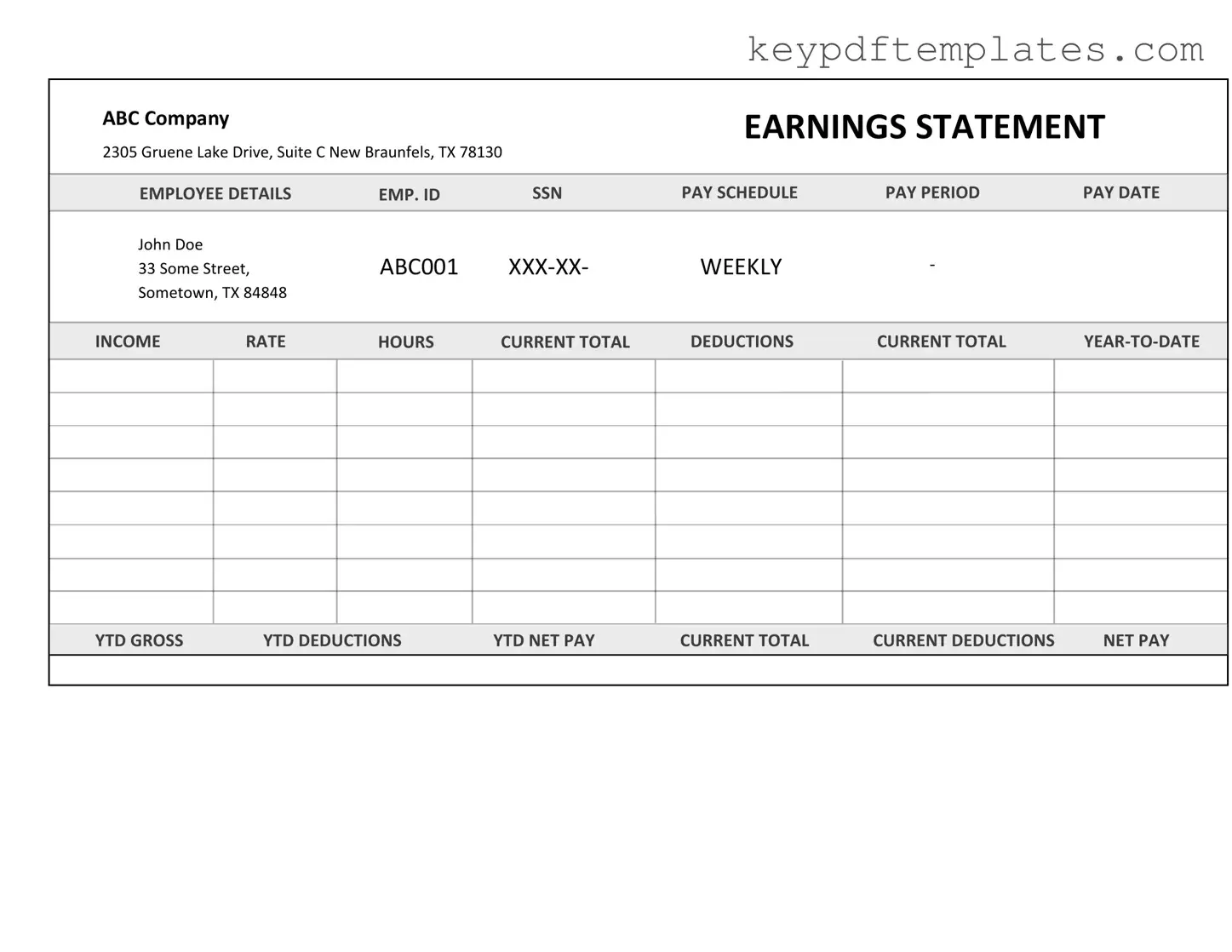

| Definition | An Independent Contractor Pay Stub is a document provided to independent contractors that outlines their earnings and deductions for a specific pay period. |

| Purpose | The pay stub serves to inform independent contractors of their payment details, including gross pay, net pay, and any applicable deductions. |

| Components | Typically, a pay stub includes the contractor's name, payment date, hours worked, rate of pay, and any deductions. |

| Frequency | Independent contractors may receive pay stubs weekly, bi-weekly, or monthly, depending on the agreement with the hiring entity. |

| Tax Implications | Independent contractors are responsible for reporting their income and paying self-employment taxes, as no taxes are withheld from their pay. |

| State-Specific Forms | Some states may require specific formats or additional information on pay stubs; for example, California requires detailed reporting under the Labor Code. |

| Record Keeping | Independent contractors should keep copies of their pay stubs for tax purposes and to track their earnings over time. |

| Legal Requirements | While not universally mandated, providing pay stubs can help ensure transparency and compliance with state labor laws. |

| Electronic Pay Stubs | Many businesses now offer electronic pay stubs, which can be accessed online, providing convenience for independent contractors. |

Documents used along the form

When working with independent contractors, several forms and documents complement the Independent Contractor Pay Stub. Each of these documents serves a specific purpose, ensuring clear communication and proper record-keeping between the contractor and the hiring entity.

- Independent Contractor Agreement: This document outlines the terms of the working relationship, including payment terms, project scope, and deadlines.

- W-9 Form: Contractors complete this form to provide their taxpayer identification information, which is necessary for tax reporting purposes.

- Georgia Divorce Form: Essential for initiating the divorce process in Georgia, this legal document outlines residency requirements, custody arrangements, and grounds for divorce; complete it by visiting Georgia PDF.

- Invoice: An invoice is submitted by the contractor to request payment for services rendered. It details the work completed and the amount due.

- 1099-MISC Form: This tax form is issued to contractors at the end of the year, summarizing their earnings for tax reporting.

- Time Sheet: A time sheet records the hours worked by the contractor. This document may be used to verify hours for payment calculations.

- Confidentiality Agreement: This agreement protects sensitive information shared between the contractor and the hiring entity during the project.

- Scope of Work Document: This document details the specific tasks and responsibilities of the contractor, ensuring clarity on project expectations.

- Termination Notice: If either party wishes to end the contract, a termination notice outlines the reasons and effective date of termination.

These documents play a vital role in managing the relationship between independent contractors and their clients. Proper use of these forms helps prevent misunderstandings and supports compliance with tax regulations.