Get IRS W-9 Form

Key takeaways

The IRS W-9 form is an important document for individuals and businesses alike. It helps ensure accurate reporting of income and tax obligations. Here are some key takeaways to keep in mind when filling out and using the W-9 form:

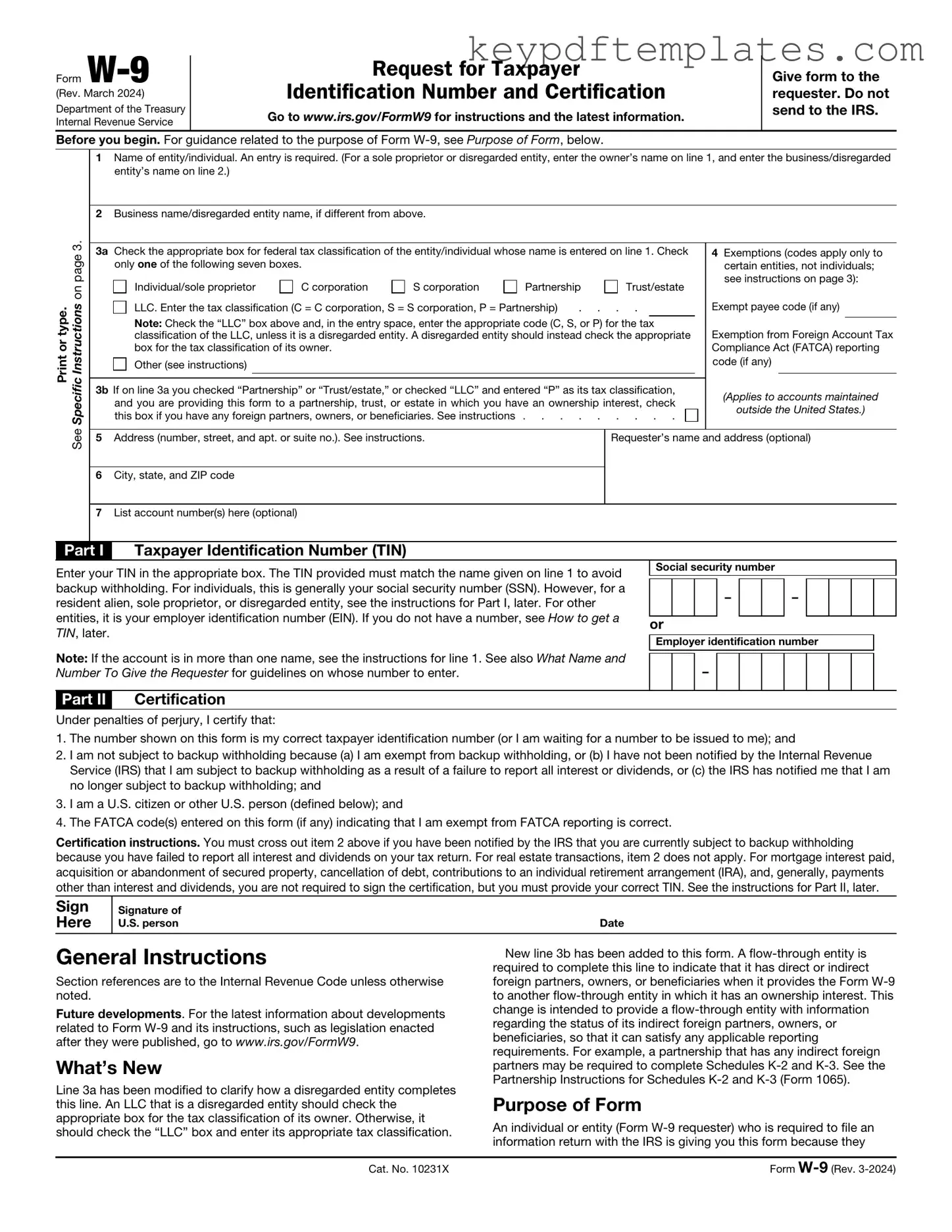

- Purpose of the W-9: The form is used to provide your taxpayer identification number (TIN) to entities that need to report payments made to you.

- Who Needs to Fill It Out: Freelancers, contractors, and vendors typically need to complete the W-9 when working with businesses that will report their earnings to the IRS.

- Accuracy is Key: Ensure that the name and TIN you provide match what the IRS has on file. Mistakes can lead to delays and issues with tax reporting.

- Signature Requirement: Don’t forget to sign and date the form. Your signature certifies that the information provided is accurate.

- Submitting the Form: Send the completed W-9 directly to the requester, not the IRS. Keep a copy for your records.

- Privacy Matters: Be cautious when sharing your W-9. Only provide it to trusted parties to protect your personal information.

- Updating Your W-9: If your information changes, such as your name or TIN, fill out a new W-9 and provide it to the necessary parties.

By understanding these key points, you can navigate the W-9 form process with confidence and ensure compliance with tax regulations.

Similar forms

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. Like the W-9, it collects personal information and helps determine withholding amounts.

-

Texas Motorcycle Bill of Sale: This document serves to formalize the transfer of motorcycle ownership, detailing key information such as make, model, and VIN. Completing a Motorcycle Bill of Sale form is essential for protecting both the buyer's and seller's interests in the transaction.

- 1099 Form: Issued to independent contractors, this form reports income paid to them. It complements the W-9, as the W-9 provides the necessary taxpayer information to complete the 1099.

- W-8BEN Form: Used by foreign individuals to certify their foreign status and claim tax treaty benefits. Similar to the W-9, it collects identifying information but is tailored for non-U.S. persons.

- Schedule C: This document reports income and expenses for sole proprietors. While the W-9 collects information, Schedule C provides a detailed account of earnings, linking back to the information on the W-9.

- Form 8832: This form allows a business entity to choose how it will be classified for federal tax purposes. It requires basic information similar to what is found on the W-9.

- Form SS-4: This application for an Employer Identification Number (EIN) gathers essential information about a business entity. Like the W-9, it requires identifying details about the entity or individual.

- Form 1040: The individual income tax return form collects comprehensive financial information. It relies on data that may be derived from the W-9, particularly for reporting income from various sources.

- Form 1065: This partnership tax return form requires information about the partners and the partnership itself. It shares similarities with the W-9 in that it gathers identifying information about individuals involved.

Misconceptions

The IRS W-9 form is a commonly used document, but there are several misconceptions surrounding it. Understanding these misconceptions can help individuals and businesses navigate tax-related matters more effectively.

- Misconception 1: The W-9 form is only for independent contractors.

- Misconception 2: Submitting a W-9 means you will be audited.

- Misconception 3: The W-9 form is the same as a W-2 form.

- Misconception 4: You must submit a W-9 every year.

- Misconception 5: Only U.S. citizens can fill out a W-9.

- Misconception 6: The W-9 form is only for tax purposes.

- Misconception 7: You should send your W-9 to the IRS.

- Misconception 8: Completing a W-9 guarantees you will receive a 1099 form.

While independent contractors often use the W-9 form to provide their taxpayer identification information, it is also used by various entities, including freelancers, vendors, and even some businesses that need to report payments made to others.

Providing a W-9 does not trigger an audit. The form is primarily used for information reporting purposes and does not directly affect your likelihood of being audited.

The W-9 form is different from the W-2 form. A W-2 is used by employers to report wages paid to employees, while the W-9 is for individuals or entities to provide their taxpayer identification information.

A W-9 does not need to be submitted annually. You only need to provide a new W-9 if your information changes, such as your name or taxpayer identification number.

Non-U.S. citizens who are residents can also complete a W-9 if they have a taxpayer identification number. However, non-resident aliens typically use a different form, the W-8.

While the primary purpose of the W-9 is tax-related, it can also be used for other business transactions that require verification of taxpayer identification.

The W-9 form is not submitted to the IRS. Instead, it is provided to the person or business requesting it, who will then use the information for their reporting purposes.

Filling out a W-9 does not guarantee that you will receive a 1099 form. A 1099 is issued only if certain payment thresholds are met, and not all payments require a 1099.

More PDF Templates

Profits or Loss From Business - Each part of Schedule C is specifically designed to capture important business-related data.

For businesses looking to establish a solid foundation, an effective Operating Agreement template is crucial, as it provides a clear framework for managing member roles and responsibilities within an LLC.

Repair Estimate Template - Include any symptoms or issues your vehicle is experiencing.

Roof Guarantee - Transfer your warranty with just a written request and a signature.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The IRS W-9 form is used to provide taxpayer information to entities that will pay you income. This includes businesses and individuals who may need to report payments made to you. |

| Tax Identification Number | On the W-9 form, you must provide your Taxpayer Identification Number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN). |

| Certification | By signing the W-9, you certify that the information provided is correct and that you are not subject to backup withholding. |

| State-Specific Forms | Some states have their own versions of the W-9 form. For example, California requires the use of Form 590 to report withholding information under California law. |

| Submission | The completed W-9 form should not be sent to the IRS. Instead, it is submitted directly to the requesting entity, such as an employer or financial institution. |

Documents used along the form

The IRS W-9 form is commonly used to provide taxpayer identification information to entities that need it for reporting purposes. Along with the W-9, several other forms and documents may be necessary, depending on the context of the transaction or relationship. Below are some key documents that are often used in conjunction with the W-9 form.

- IRS 1099 Form: This form reports various types of income other than wages, salaries, and tips. Businesses use it to report payments made to independent contractors and freelancers, who typically submit a W-9 to provide their taxpayer identification number.

- IRS 1040 Form: This is the standard individual income tax return form used by U.S. citizens and residents. Income reported on 1099 forms is often included in the taxpayer's annual 1040 filing.

- IRS 8832 Form: This form is used by eligible entities to elect to be classified as a corporation or partnership for federal tax purposes. It may be relevant for businesses that need to provide a W-9 for tax classification purposes.

- Business License: Many states require businesses to obtain a license to operate legally. This document may be requested alongside a W-9 when establishing a business relationship.

- Contract or Agreement: A written contract outlines the terms of a working relationship. It often accompanies the W-9 when hiring independent contractors or freelancers.

- California Residential Lease Agreement: This essential document serves as a legally binding contract between landlords and tenants, ensuring clarity and protection for both parties. For more information and resources, visit Top Forms Online.

- IRS SS-4 Form: This form is used to apply for an Employer Identification Number (EIN). Businesses may submit this form to the IRS before providing a W-9, especially if they are new entities.

Understanding these documents can help ensure compliance with tax reporting requirements and facilitate smooth business transactions. Each form serves a specific purpose, and together they create a comprehensive framework for managing financial relationships.