Get Mortgage Statement Form

Key takeaways

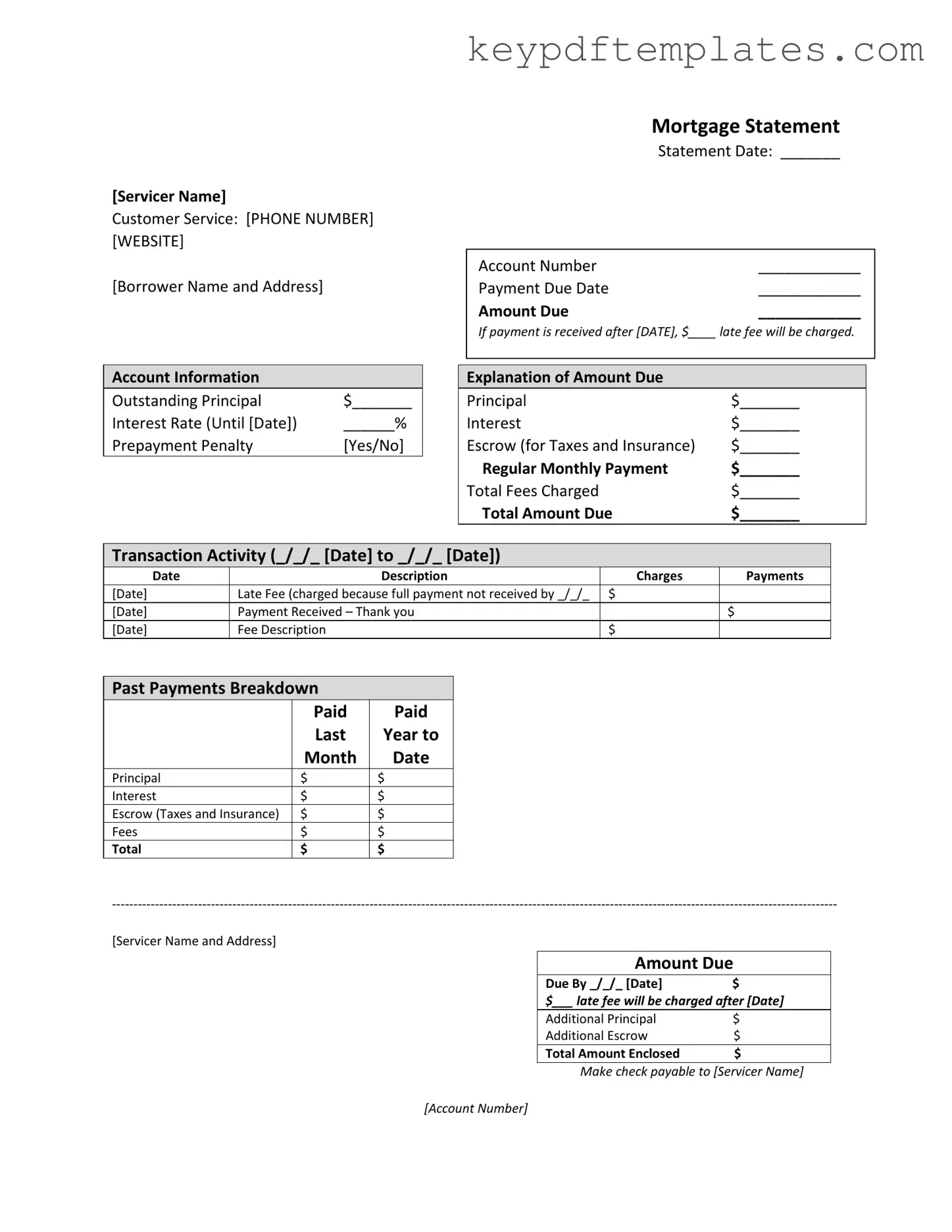

Understanding the Mortgage Statement form is essential for managing your mortgage effectively. Here are some key takeaways to consider:

- Payment Details: Always check the payment due date and the total amount due. Late fees may apply if payment is not received by the specified date.

- Account Information: Review the outstanding principal and interest rate. This information is crucial for understanding your financial obligations.

- Transaction Activity: Keep track of your payment history and any fees charged. This section provides a clear overview of your account status and recent transactions.

- Partial Payments: Be aware that any partial payments are held in a suspense account and do not count towards your mortgage until the full balance is paid.

By staying informed about these aspects of your mortgage statement, you can better manage your payments and avoid potential issues.

Similar forms

- Billing Statement: Like a mortgage statement, a billing statement outlines what you owe for services. It details charges, payments, and any late fees. Both documents help you track your financial obligations.

-

Trailer Bill of Sale: This form, crucial for documenting the transfer of ownership of a trailer in Texas, ensures that the buyer has proof of ownership. For more information and to obtain a template, visit https://txtemplate.com/trailer-bill-of-sale-pdf-template/.

- Loan Statement: A loan statement provides information about the remaining balance on a loan, interest rates, and payment history. Similar to a mortgage statement, it gives a clear picture of what you owe and when payments are due.

- Account Summary: An account summary presents an overview of your account activity. This includes transactions, fees, and balances. It is similar to a mortgage statement in that it summarizes financial information in a straightforward manner.

- Payment History: A payment history document shows all payments made over a specific period. Like a mortgage statement, it helps you see if you are current on your payments and highlights any outstanding amounts.

- Credit Report: A credit report includes details about your credit history, including loans and payment behavior. While more comprehensive, it shares similarities with a mortgage statement by showing how timely payments affect your financial standing.

Misconceptions

Understanding mortgage statements is crucial for homeowners. However, many misconceptions can lead to confusion and mismanagement of finances. Below are eight common misconceptions about the mortgage statement form, along with clarifications to help homeowners navigate their mortgage obligations effectively.

- Misconception 1: The mortgage statement is just a bill.

- Misconception 2: Late fees are automatically applied.

- Misconception 3: Partial payments are applied to the mortgage balance.

- Misconception 4: The interest rate is fixed for the entire loan term.

- Misconception 5: Escrow payments are optional.

- Misconception 6: The total amount due includes only the monthly payment.

- Misconception 7: Payment history is irrelevant.

- Misconception 8: If I am experiencing financial difficulty, I should wait to reach out.

Many believe that the mortgage statement is merely a request for payment. In reality, it provides a comprehensive overview of the loan status, including principal balance, interest rates, and any fees incurred.

Some homeowners think that late fees are charged immediately after the payment due date. However, a grace period is often provided, and fees are only applied if payment is not received by a specified date.

This is a common misunderstanding. In fact, partial payments are held in a suspense account and do not reduce the mortgage balance until the full payment is made.

Homeowners may assume their interest rate remains constant. However, many loans have adjustable rates that can change over time, affecting monthly payments.

Some believe that escrow payments for taxes and insurance can be skipped. In most cases, lenders require these payments to ensure that property taxes and insurance are paid on time.

Homeowners might think that the total amount due is solely the monthly payment. However, it also includes any outstanding fees, late charges, and escrow contributions.

Some borrowers overlook the importance of their payment history. The mortgage statement often includes this information, which can impact credit scores and future borrowing ability.

Many individuals feel embarrassed or reluctant to ask for help. However, it is crucial to contact the lender as soon as financial difficulties arise. Most lenders offer resources and counseling to assist homeowners in distress.

By addressing these misconceptions, homeowners can gain a clearer understanding of their mortgage statements and make informed decisions regarding their financial obligations.

More PDF Templates

Texas Drivers License Renewal Form Dl-43 - This form is essential for reporting lost or stolen vehicle registration documents.

The Chick Fil A Job Application form serves as the first step for prospective employees to express their interest in joining the renowned fast-food chain. This document gathers essential personal, educational, and professional information required for employment consideration. It's a crucial bridge connecting job seekers with potential employment opportunities at Chick Fil A. For those looking to fill out this application, you can read more about the form.

Scheudle C - The form includes sections for both business income and expenses, making it comprehensive.

Odometer Disclosure Statement Ca - Each vehicle transaction involving a title transfer typically necessitates this statement.

Form Specs

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Payment Details | It specifies the payment due date, the amount due, and any late fees that may apply if payment is not received on time. |

| Outstanding Principal | The statement lists the outstanding principal balance, interest rate, and any applicable prepayment penalties. |

| Transaction Activity | It provides a breakdown of transaction activity, including dates, descriptions of charges, and payments made during the specified period. |

| Delinquency Notice | A notice informs the borrower of any delinquency, warning that failure to pay may lead to fees or foreclosure. |

Documents used along the form

When managing a mortgage, several documents may accompany the Mortgage Statement form. Each of these documents serves a unique purpose in tracking payments, understanding loan terms, or addressing any issues that may arise. Below is a list of commonly used forms and documents.

- Loan Agreement: This document outlines the terms of the mortgage, including the loan amount, interest rate, repayment schedule, and obligations of both the borrower and the lender.

- Payment History: A detailed record of all payments made on the mortgage. This document helps borrowers track their payment history and understand any outstanding balances.

- Escrow Analysis Statement: This statement provides a breakdown of the escrow account, showing how much is collected for property taxes and insurance. It also indicates whether the account has a surplus or shortage.

- Delinquency Notice: Issued when payments are late, this notice informs the borrower of their delinquent status and outlines potential consequences, such as late fees or foreclosure.

- Power of Attorney: A Power of Attorney can be crucial in mortgage matters, allowing an appointed agent to manage financial transactions on behalf of the principal, especially in cases where the borrower is unable to act. More information can be found at https://allfloridaforms.com.

- Modification Agreement: If a borrower seeks to change the terms of their loan, this document formalizes any adjustments made to the mortgage, such as changes to the interest rate or payment schedule.

- Payoff Statement: This document details the total amount needed to pay off the mortgage in full. It includes principal, interest, and any fees that may apply.

Understanding these documents can help borrowers effectively manage their mortgage and stay informed about their financial obligations. Each plays a crucial role in the overall mortgage process and can provide valuable insights into the status of the loan.