Get P 45 It Form

Key takeaways

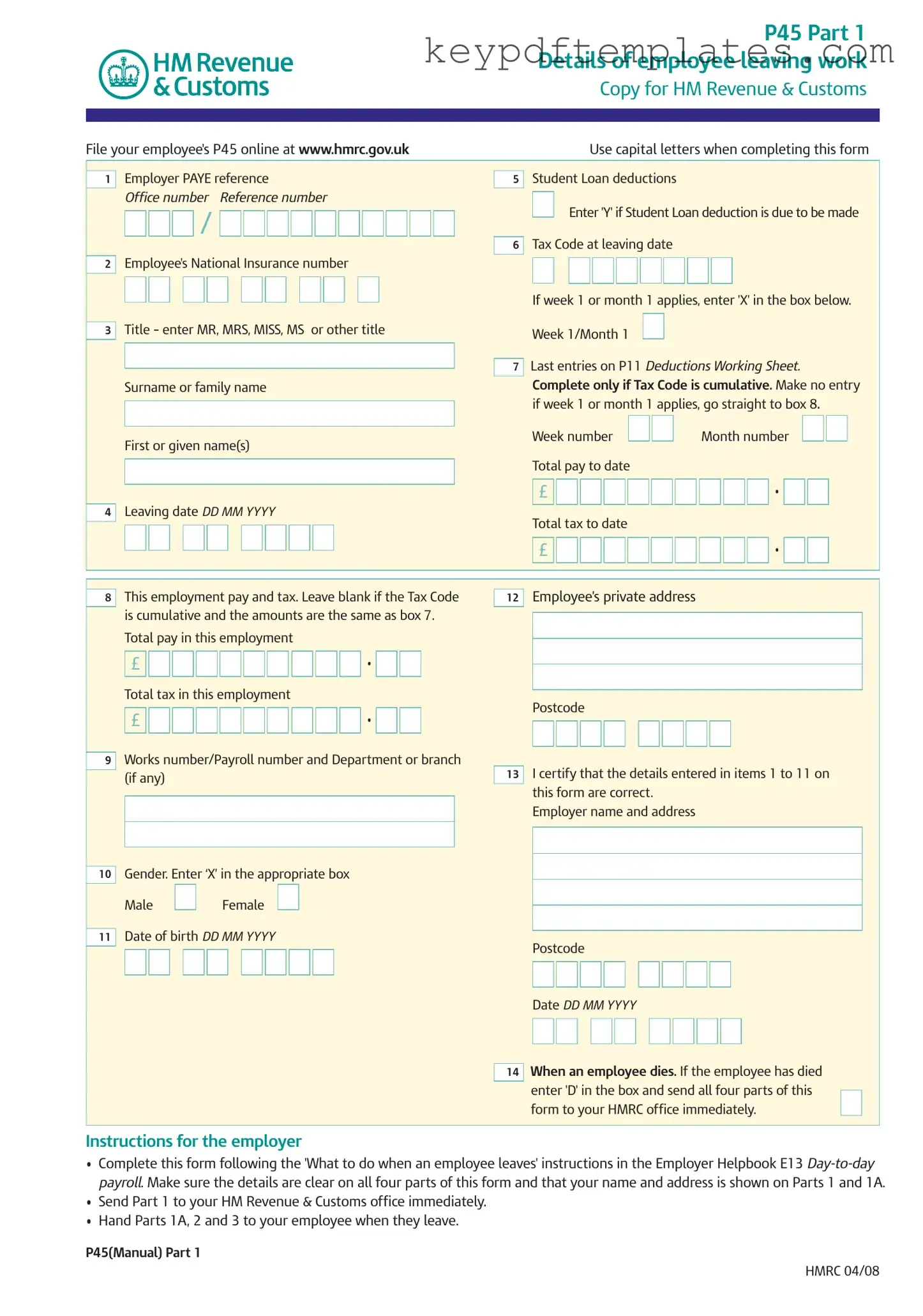

The P45 form is essential when an employee leaves a job. It provides important details about their earnings and tax deductions, which are necessary for both the employee and the new employer.

Employers must complete the P45 accurately. This includes entering the employee's National Insurance number, tax code, and total pay and tax to date. Clarity is crucial to avoid any tax complications.

Employees should keep Part 1A of the P45 safe. This part is vital for tax returns and may be needed for future claims, such as Jobseeker's Allowance.

If an employee has a Student Loan, it's important to indicate this on the form. This ensures that the correct deductions continue with their new employer.

When transferring the P45 to a new employer, employees should hand over Parts 2 and 3. Not doing so may result in incorrect tax deductions, leading to potential overpayment.

Similar forms

- P60: This document summarizes an employee's total pay and tax deductions for the entire tax year. Like the P45, it is essential for tax records and filing returns.

- P11D: The P11D form details benefits and expenses provided to employees. Both forms are used to report financial information to HM Revenue & Customs.

- P85: This form is for individuals leaving the UK to claim tax refunds. Similar to the P45, it addresses changes in employment status and tax obligations.

- W-2: Issued in the U.S., the W-2 provides information on wages and taxes withheld. Both documents serve to inform employees about their earnings and tax contributions.

- Motor Vehicle Bill of Sale: This legal document is essential for the transfer of vehicle ownership and verification of purchase, ensuring accuracy in transactions. For more information, visit vehiclebillofsaleform.com/.

- 1099-MISC: This form is used for independent contractors in the U.S. to report income. Like the P45, it is crucial for tax reporting and compliance.

- Form 1040: This is the U.S. individual income tax return. While the P45 is specific to employment termination, both forms are used to report income and calculate tax obligations.

Misconceptions

Here are five common misconceptions about the P45 form:

- The P45 is only needed for tax purposes. While the P45 is primarily used to report tax details, it also serves as proof of employment and is necessary for claiming certain benefits.

- You do not need to keep your P45 once you start a new job. It is important to keep your P45, especially Part 1A, as you may need it for future tax returns or other financial matters.

- The P45 is automatically sent to your new employer. This is not true. It is the employee's responsibility to provide the P45 to their new employer. Failure to do so may result in higher tax deductions.

- The P45 form is the same for all employees. Each P45 is unique to the individual employee, containing specific details such as their tax code, National Insurance number, and pay to date.

- You can easily obtain a replacement P45. Unfortunately, copies of the P45 are not available. If lost, you will need to contact your previous employer for the information.

More PDF Templates

Profits or Loss From Business - Be mindful of the deadlines for submitting Schedule C along with your tax return.

Certified Copy of Birth Certificate - The document may also indicate if the birth was part of a home birth or hospital birth setting.

In order to effectively initiate the eviction process, landlords must ensure they are using the correct documentation, such as the Notice to Quit form, which can be accessed through Florida PDF Forms, providing a clear pathway for compliance and clarity for all parties involved.

How Long Does It Take to Get on Section 8 - Approval of your request means adhering to additional requirements.

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The P45 form is used when an employee leaves a job. It provides important details about their employment and tax information. |

| Parts of the Form | The P45 consists of three parts: Part 1 for HM Revenue & Customs, Part 1A for the employee, and Parts 2 and 3 for the new employer. |

| Employee Information | It includes the employee’s name, National Insurance number, leaving date, and total pay and tax details. |

| Tax Codes | Tax codes are indicated on the form. If a week 1 or month 1 tax code applies, it must be marked with an 'X'. |

| Student Loans | The form indicates if student loan deductions are applicable. Employers must check the relevant boxes. |

| Employer Responsibilities | Employers must complete and send Part 1 to HMRC immediately after an employee leaves. |

| Employee Responsibilities | Employees should keep Part 1A safe as it may be needed for tax returns or when starting a new job. |

| HMRC Website | Employers can file the P45 online at www.hmrc.gov.uk for efficiency and record-keeping. |

| Legal Framework | The P45 form is governed by UK tax laws, specifically the Income Tax (Pay As You Earn) Regulations. |

Documents used along the form

The P45 form is a crucial document for employees leaving a job in the UK, providing essential details about their earnings and tax deductions. However, several other forms and documents accompany the P45, each serving specific purposes in the employment and tax processes. Below is a list of five commonly used forms and documents that often accompany the P45.

- P60: This document summarizes an employee's total pay and deductions for the entire tax year. Employers must provide a P60 to each employee by May 31st following the end of the tax year. It serves as proof of income and tax paid, which is essential for tax returns and financial planning.

- P50: Used for claiming a tax refund after leaving a job, the P50 form allows individuals to request a refund of any overpaid tax. Employees can use this form if they have stopped working and have paid tax in the current tax year.

- P85: This form is necessary for individuals leaving the UK to work abroad or for those returning to their home country. The P85 helps taxpayers inform HM Revenue & Customs (HMRC) of their departure and can assist in claiming any tax refunds due.

- P11D: Employers use the P11D form to report expenses and benefits provided to employees. This form is crucial for calculating any additional tax liabilities that may arise from non-cash benefits, such as company cars or health insurance.

- RV Bill of Sale: Essential for anyone buying or selling a recreational vehicle in Texas, this legal document ensures proof of ownership transfer. For details and to access the form, visit https://txtemplate.com/rv-bill-of-sale-pdf-template/.

- Tax Return (Self Assessment): For those who are self-employed or have additional income sources, a tax return is necessary to report earnings and calculate tax owed. This document is essential for individuals who need to declare income that isn't covered by the P45.

Understanding these forms and their purposes can help employees navigate the complexities of leaving a job and managing their tax obligations. Each document plays a vital role in ensuring a smooth transition and compliance with tax regulations.